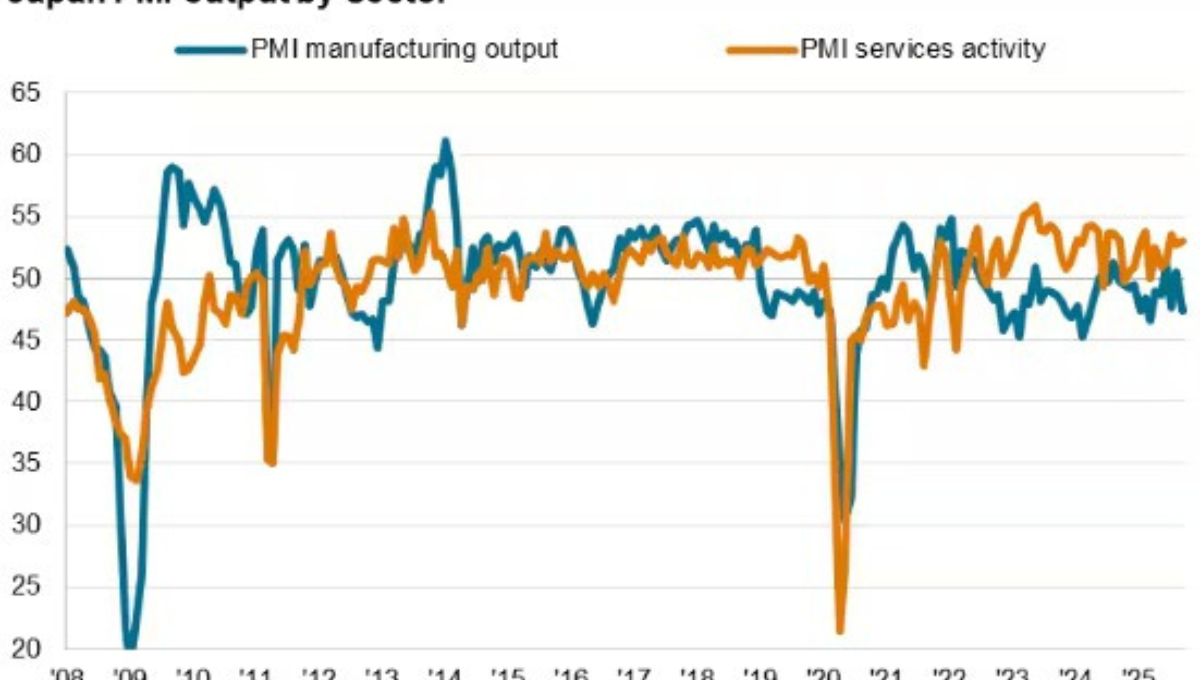

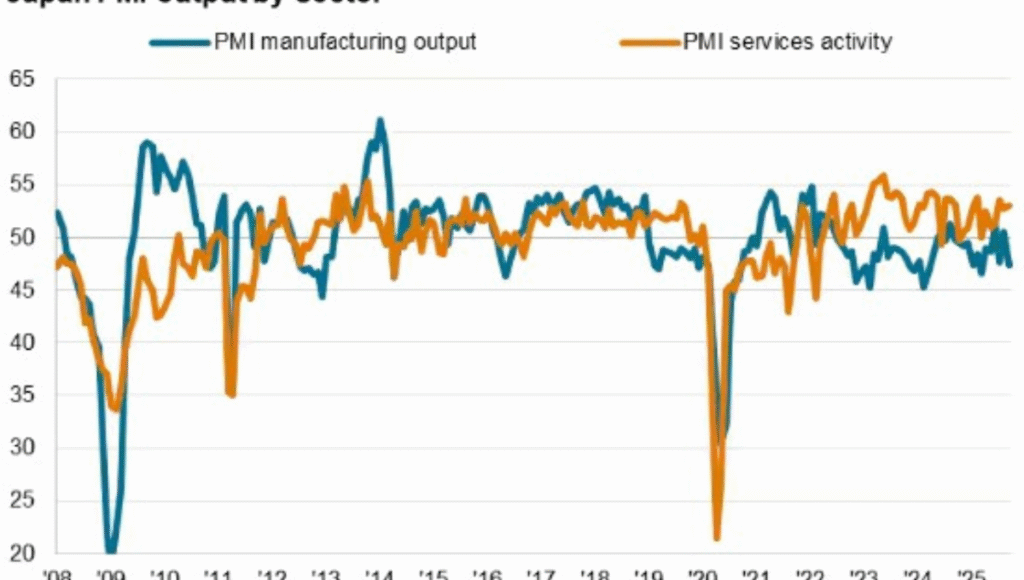

Japan Economic Growth Slows as Manufacturing Struggles Deepen

Japan economy, often celebrated for its resilience, is showing signs of caution as recent data reveals a slowdown in business activity growth. According to the latest S&P Global Flash Japan PMI, September marked the slowest expansion in four months, highlighting a divergence between the booming service sector and the struggling manufacturing industry. While service providers continue to thrive, Japan’s factories are facing headwinds that could influence the country’s economic trajectory in the months ahead.

Services Keep the Economy Moving

Despite the overall slowdown, the services sector continues to show remarkable strength. Firms across retail, finance, and technology reported steady growth, driven largely by domestic demand. Companies noted rising client interest, with new business expanding at a pace consistent with the previous month. This growth is reflected in the employment trends within services, where staffing levels rose as businesses sought to meet increased activity.

The continued rise in service sector confidence also underlines a positive trend for consumer-oriented industries, which remain a bright spot in Japan’s economy. Service providers are clearly benefiting from stable domestic demand, helping to offset some of the downturn pressures seen in manufacturing.

Manufacturing Faces Tough Times

In contrast, the manufacturing sector’s troubles are growing. September marked the third consecutive month of contraction in output, with the pace of decline reaching a six-month high. Companies reported a sharper fall in new orders, both domestically and internationally, partly due to cautious inventory management and the lingering effects of U.S. tariffs on Japanese exports.

The downturn in manufacturing is not just a temporary dip. Export orders for goods have now declined for the fifteenth consecutive month, reflecting ongoing global trade challenges. Confidence among manufacturers has also weakened, falling to its lowest level since April, signaling caution in investment and hiring plans.

Diverging Sector Outlooks

The latest PMI data points to a two-speed economy, where service industries continue to grow while manufacturing struggles. Forward-looking indicators suggest that this divergence may continue, with the services sector poised for steady demand and expansion, while manufacturers brace for further headwinds from global trade tensions and rising production costs.

Employment trends further underscore this divide. While service sector hiring continues, manufacturing headcounts fell in September for the first time in ten months. This reflects the cautious stance of firms amid slower orders and shrinking profit margins.

Inflation Pressures Remain

Adding complexity to Japan’s economic picture is the persistence of elevated price pressures. Selling price inflation increased in September, largely due to rising manufacturing costs, although service sector pricing also remained firm. Businesses reported passing on higher costs to customers, signaling that consumer price inflation could remain around 2% in the coming months.

This inflationary trend presents a dilemma for the Bank of Japan. Softening business activity and rising prices pull the interest rate path in different directions. While the central bank is likely to proceed with a policy rate hike in December to gradually normalize rates from a long period of ultra-low interest, the manufacturing downturn will be a key factor to watch.

Looking Ahead: Balancing Growth and Caution

The September PMI highlights Japan’s delicate balancing act. While services keep the domestic economy buoyant, manufacturing struggles pose a risk to overall GDP growth. Analysts estimate that the current PMI reading is indicative of around 0.5% quarterly GDP growth—a modest pace that is slightly above the decade-long average.

Japan’s policymakers and business leaders now face the challenge of sustaining growth in services while addressing the vulnerabilities in manufacturing. Export-oriented sectors will need strategic adaptation to mitigate the effects of global trade pressures, particularly U.S. tariffs, while domestic demand continues to drive optimism in consumer-facing industries.

The coming months will be crucial as Japan navigates these opposing forces, seeking to ensure a stable and sustainable economic recovery. Investors, companies, and consumers alike will be closely monitoring how the country balances growth, employment, and inflation in an increasingly complex global environment.

Disclaimer: This article is based on publicly available information from S&P Global and other sources. It is intended for informational purposes only and does not constitute financial advice or professional guidance.